The enterprise identification number (EIN) is a unique identifier issued to businesses upon registration, serving as both the tax and social insurance number. Understanding its role and the registration process is essential for business compliance and smooth operations.

What is the enterprise identification number?

Identification number of an enterprise is a sequence of digits created by the national information system on business registration, granted to the enterprise upon its establishment and recorded in the enterprise registration certificate. A sole identification number shall be granted to an enterprise and may not be reused for another enterprise (pursuant to Clause 1, Article 29 of the 2020 Enterprise Law).

At the same time, Article 8 of Decree No. 01/2021/ND-CP regulates enterprise identification number as follows:

- Identification number concurrently serves as tax identification number and social insurance identification number of the enterprise.

- An enterprise identification number will exist throughout the course of operation of the enterprise and may not be re-issued to another organization or individual. When the nêtrprise terminates its operation, its enterprise identification number will be invalidated.

- Enterprise identification numbers shall be automatically created, sent and rêcived by the national ìnormation system on business registration and tax registration system and stated in enterprise registration certificates.

Is the enterprise identification number the same as the business tax number?

Based on the provisions of Article 8 of Decree 01/2021/ND-CP, each business is granted a unique identification number, referred to as the enterprise identification number. This number also serves as the tax identification number and the social insurance number for the business.

The enterprise identification number remains valid throughout the business’s operations and cannot be reissued to another organization or individual. When the business ceases operations, the enterprise identification number becomes invalid.

The enterprise identification number is generated, sent, and received automatically by the National Business Registration Information System, the Tax Registration Information System, and is recorded on the Business Registration Certificate.

For businesses established and operating under an Investment License or Investment Certificate (which also serves as the Business Registration Certificate) or other equivalent legal documents, such as a Securities Business License, the enterprise identification number is the tax identification number issued by the tax authority.

Regulations on the Creation of Enterprise Identification Numbers

Pursuant to Article 8 of Decree 01/2021/ND-CP, the creation of a enterprise identification number must comply with the following regulations:

- The enterprise ID number exists throughout its operation and shall not be issued to any other entity. When an enterprise ceases to operate, the enterprise ID number will be invalidated.

- Enterprise ID numbers are created, sent and received automatically by the National Enterprise Registration Information System, tax registration information system, and written on enterprise registration certificates.

- Regulatory agencies shall uniformly use enterprise ID numbers to perform state management tasks and exchange information about enterprises.

- A branch or representative office of the business is issued to the enterprise’s branches and representative offices.

- The ID number of a business location is a series of 5 digits from 00001 to 99999. This number is not the tax identification number for the business location.

- In case the TIN of the enterprise, or its branch or representative office is invalidated as a result of its commission of tax offences, this TIN must not be used in business transactions from the day on which the TIN invalidation is announced by the tax authority.

- With regard to branches and representative offices that are established before November 01, 2015 but have not had their own ID numbers, the enterprise shall directly contact the tax authority to be issued with a 13-digit TIN, and then follow procedures for change of the registration information at the business registration authority as prescribed.

- Enterprise ID numbers of enterprises that are established and operating under the investment license or investment certificate (also the business registration certificate) or another document of equivalent validity, or securities trading license shall be their TINs issued by tax authorities.

Procedure for Registering a Enterprise Identification Number (Enterprise Establishment Registration Procedure)

Since the enterprise identification number also serves as the tax identification number and is issued when you register your business, the procedure for registering the enterprise identification number (tax number) is the same as the procedure for establishing a business.

Step 1: Prepare the enterprise registration dossiers.

The dossiers required include:

- Application for enterprise registration

- Company charter

- List of founding shareholders or members

- Notarized copy of the ID card (CCCD) or passport of the legal representative, company members, or shareholders

- Power of attorney if the person submitting the registration is not the legal representative

- Notarized copy of the ID card (CCCD) or passport of the authorized person.

Step 2: Submit the application to the Business Registration Office in the province or city where the business headquarters is located.

Step 3: Receive the result within 3 working days.

When is an enterprise identification number invalidated?

Clause 2, Article 8 of Decree No. 01/2021/ND-CP on enterprise registration states that: “When the enterprise terminates its operation, its enterprise identification number will be invalidated.”

In addition, the enterprise identification number may also be invalidated in case of violating law on enterprise management such as violation of the tax laws as prescribed in Clause 7, Article 8 of the Decree No. 01/2021/ND-CP. H However, the scope of termination only applies to that field of management, specifically in this case, businesses and dependent units are only not allowed to use such tax identification number in economic transactions from the date the tax office publicly announces the invalidation of the tax identification number.

How to look up the enterprise identification number?

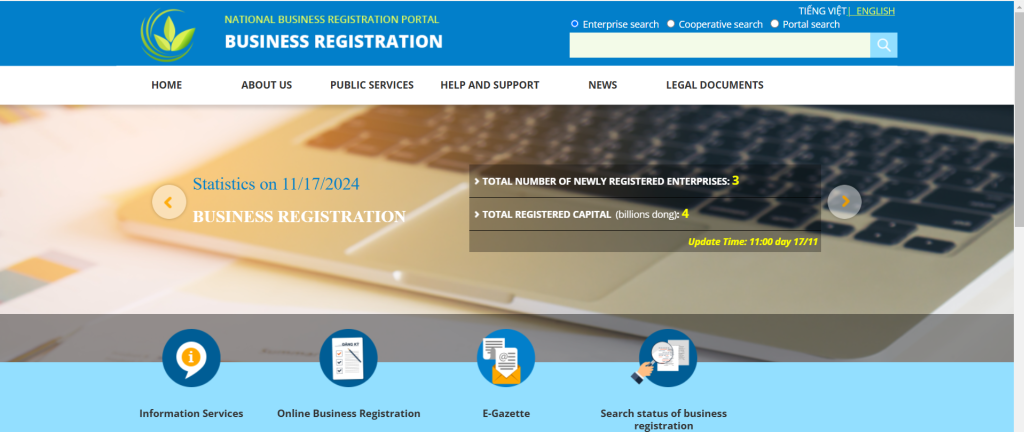

The enterprise identification numbers are looked up and provided publicly and free of charge on the National Business Registration Portal. Pursuant to Article 36 of Decree No. 01/2021/ND-CP, organizations and individuals can look up an enterprise identification number according to the following steps:

Step 1: Access the National Business Registration Portal at https://dangkylanhdoanh.gov.vn

Step 2: Select the search for the enterprise section, then enter the company name. There will be suggestions for similar company names. Select the exact name of the company you want to search for and click search (magnifying glass icon).

Step 3: The system will display enterprise information such as: Vietnamese name, abbreviation, operating status, identification number, legal representative, headquarters address, industry and profession…

In conclusion, the enterprise identification number is vital for legal and tax compliance, ensuring transparency and effective business management. Proper registration and adherence to regulations help businesses avoid legal issues and maintain smooth operations.

———————————-

📞 CONTACT LEGAL CONSULTANT:

TLA Law is a leading law firm with a team of highly experienced lawyers specializing in criminal, civil, corporate, marriage and family law, and more. We are committed to providing comprehensive legal support and answering all your legal questions. If you have any further questions, please do not hesitate to contact us.

1. Lawyer Vu Thi Phuong Thanh, Manager of TLA Law LLC, Ha Noi Bar Association

Email: vtpthanh@tlalaw.vn

2. Lawyer Tran My Le, Chairman of the Members’ Council, Ha Noi Bar Association

Email: tmle@tlalaw.vn.

-Nguyen Huong Huyen-