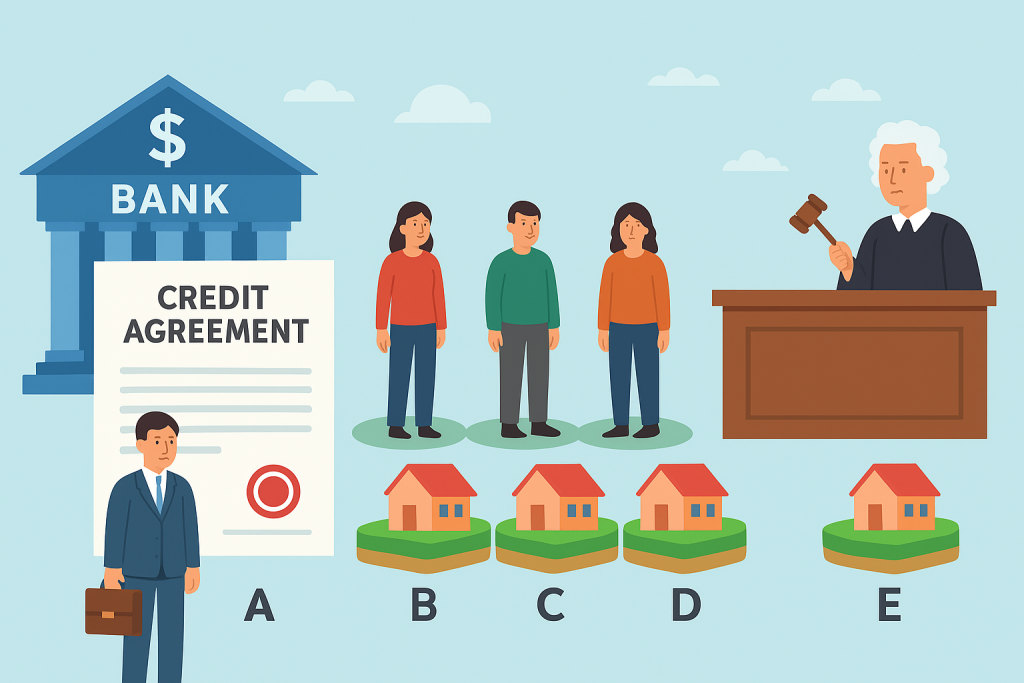

In a credit contract dispute, Party A borrowed a sum of money from a Bank. To secure A’s loan, Parties B, C, D, and E provided guarantees using their separate land-use rights. A failed to fulfill the repayment obligation. The Bank filed a lawsuit requesting A to repay the loan, and if A fails to pay, requested the Court to enforce the collateral of B, C, D, and E to recover the debt.

However, the Bank could not determine the specific scope of collateral for each asset securing A’s loan and proposed that the Court resolve the matter based on the agreement that the collateral secures the entire loan. Similarly, B, C, D, and E could not specify the extent of their respective assets guaranteeing A’s loan. In such cases, how does the Court determine the scope of collateral during adjudication?

Context and Legal Significance

With the growing development of credit activities in Vietnam, bank loans are often secured by third-party assets to reduce risks for credit institutions. In practice, however, many disputes arise where the scope of collateral provided by guarantors is not clearly defined. This raises a crucial question about how the Court should determine the scope of collateral in adjudication. This article analyzes a practical legal scenario and relevant legal provisions to clarify the rights and obligations of the parties involved.

1. Legal Scenario

Assume the following situation in a credit contract dispute:

- The Borrower (A) borrowed money from a Bank.

- To secure the loan, B, C, D, and E guaranteed it using their separate land-use rights.

- A defaulted on repayment. The Bank filed a lawsuit demanding repayment, and if A fails to repay, requested the Court to enforce the collateral of B, C, D, and E to recover the debt.

However, the contract specifies:

- The Bank did not determine the specific scope of each collateral asset securing A’s loan.

- B, C, D, and E also did not clearly specify the scope of their assets securing the loan.

Legal Question: When adjudicating, how will the Court determine the scope of collateral?

2. Legal Basis

According to Government Decree No. 21/2021/ND-CP dated March 19, 2021, guiding the Civil Code on securing the performance of obligations:

- Clause 2, Article 5 provides:

“An obligation may be secured by multiple assets. The scope of each asset’s guarantee is determined by agreement between the guarantor and the secured party. In the absence of such an agreement, any of the assets may be used to secure the entire obligation.” - Clause 1, Article 52 also provides:

“In the case where an obligation is secured by multiple assets and the parties have not agreed on which assets to enforce, and the relevant law does not provide otherwise, the secured party has the right to select the assets to enforce or to enforce all the collateral assets.”

3. Analysis

From the above provisions, several key legal points can be drawn:

- Scope of Collateral:

- When the parties do not specifically agree on the scope of each collateral asset, any of the collateral assets may be used to secure the entire obligation.

- This ensures that the Borrower’s (A’s) obligation is fully secured, even if the specific asset-to-obligation allocation is undefined.

- Right to Select Assets for Enforcement:

- The Bank (secured party) has the right to choose which collateral to enforce, or to enforce all collateral assets simultaneously, in order to recover the debt.

- This allows the Bank to proactively exercise its debt recovery rights while complying with civil law on secured obligations.

- Application in Court Adjudication:

- When considering the Bank’s claim, the Court will base its decision on the credit contract, actual circumstances, and Articles 5 and 52 of Decree 21/2021/ND-CP to determine that:

- Each collateral asset provided by B, C, D, and E may secure the entire obligation of A.

- The Court will accept the Bank’s request to enforce all collateral assets if proposed, ensuring the secured party’s legal rights.

- When considering the Bank’s claim, the Court will base its decision on the credit contract, actual circumstances, and Articles 5 and 52 of Decree 21/2021/ND-CP to determine that:

4. Conclusion

In credit contract disputes where the scope of collateral is not specifically determined:

- Any collateral asset may be used to fulfill the entire obligation (Clause 2, Article 5, Decree 21/2021/ND-CP).

- The Bank has the right to select which asset to enforce or to enforce all collateral assets (Clause 1, Article 52, Decree 21/2021/ND-CP).

- The Court will adjudicate based on the Bank’s rights and legal provisions to ensure that the repayment obligation is fully and legally fulfilled.

Therefore, the lack of a clearly defined collateral scope does not diminish the legal effect of the collateral. On the contrary, it provides a legal basis for the Bank to proactively recover debts. This demonstrates the flexibility and protection of rights embedded in Vietnamese civil law.

📞 CONTACT LEGAL CONSULTANT:

TLA Law is a leading law firm with a team of highly experienced lawyers specializing in criminal, civil, corporate, marriage and family law, and more. We are committed to providing comprehensive legal support and answering all your legal questions. If you have any further questions, please do not hesitate to contact us.

1. Lawyer Vu Thi Phuong Thanh, Ha Noi Bar Association

Email: vtpthanh@tlalaw.vn

2. Lawyer Tran My Le, Ha Noi Bar Association

Email: tmle@tlalaw.vn

Khuong Ngoc Lan