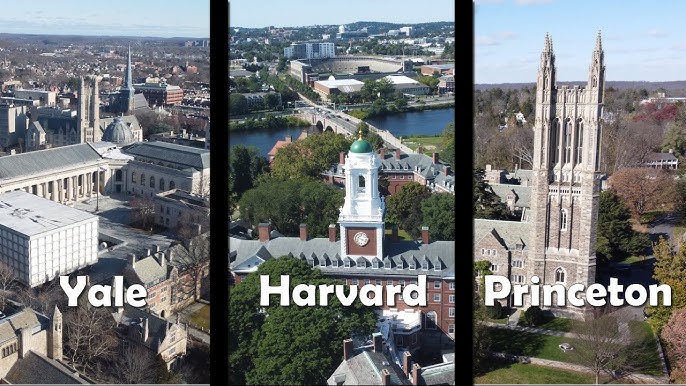

The dynamic landscape of higher education has recently witnessed an uptick in mergers and acquisitions (M&A) as institutions confront various economic, demographic, and regulatory pressures. This shift has implications for students, faculty, and the broader regulatory framework governing educational institutions. This article examines the unique legal considerations that arise in the context of M&A within the higher education sector, focusing on due diligence, regulatory compliance, and stakeholder impact.

1. Motivations for M&A in Higher Education

Several factors contribute to the trend of M&A among educational institutions. Demographic shifts, financial instability, declining enrollment rates, and increasing competition have made survival difficult for some standalone institutions. Consequently, many are choosing M&A strategies to enhance their financial standing, expand program offerings, and improve operational efficiency. This M&A movement is often framed within broader goals of educational quality, market reach, and sustainable growth.

2. Due Diligence in Educational M&A

Due diligence is a critical step in M&A transactions, particularly in higher education, where the transaction structure must align with both commercial and regulatory requirements. Key aspects of due diligence include:

- Accreditation and Licensing: Institutions must verify each other’s accreditation status and compliance with licensing requirements. Loss of accreditation would significantly affect the institution’s credibility and ability to operate.

- Financial Health: A thorough assessment of an institution’s financials is essential. This includes reviewing fu

- Intellectual Property (IP): The consolidation of IP assets—such as research, patents, and proprietary learning technologi

3. Regulatory Compliance and Approvals

Educational institutions are subject to stringent regulations at the federal, state, and,

- Federal and State Approval: Institutions must obtain approvals from accrediting bodies and may need to comply with federal agencies such as the Department of Education, which has a vested interest in maintaining standards across all education providers. At the state level, regulatory approval may be required to ensure continuity in the institution’s operational and programmatic quality.

- Antitrust Concerns: Although rare in higher education

- Employment and Labor Law Compliance: M&A often impacts faculty and staff employment agreements, union contracts, and benefits plans. Legal teams must carefully address employment law compliance to ensure that labor and faculty relations are not disrupted.

4. Stakeholder Considerations

Stakeholders in higher education M&A transactions extend beyond traditional shareholders to include students, faculty, alumni, and the local community. The transaction’s impact on students and academic staff is often a central concern, as it may alter academic programs, campus life, and institutional culture.

- Student Protections: M&A activity can lead to program restructuring or tuition changes, which may impact students financially and academically. Protecting students’ rights in such transactions is paramount, and institutions must ensure that the merger will not jeopardize students’ academic progress or financial stability.

- Faculty Rights and Tenure: Tenure and other faculty protections may be impacted, particularly if the merger entails a restructuring of academic departments. Careful consideration of faculty contracts and tenure protections is necessary to avoid potential disputes.

- Alumni and Donor Relations: M&A transactions can alter alumni and donor relationships, as these groups are often emotionally and financially invested in the institution. Clear communication strategies and assurances are essential to maintain these vital connections.

5. Post-Merger Integration Challenges

After the merger, the combined institution must address integration challenges that affect academic programs, administrative systems, and culture. This includes unifying curricula, consolidating administrative processes, and harmonizing technology platforms. Failure to effectively integrate operations can disrupt educational quality and student experiences, potentially leading to regulatory scrutiny or reputational harm.

Conclusion

M&A in higher education is a complex legal endeavor that requires careful alignment with regulatory standards, diligent protection of stakeholder interests, and seamless integration strategies. As more institutions consider M&A as a viable pathway to sustainability, legal professionals must remain vigilant to the unique challenges in this sector. The overarching goal is to ensure that such transactions enhance educational outcomes, uphold institutional integrity, and protect the rights and interests of all stakeholders involved.

CONTACT LEGAL CONSULTANT:

TLA Law is a leading law firm with a team of highly experienced lawyers specializing in criminal, civil, corporate, marriage and family law, and more. We are committed to providing comprehensive legal support and answering all your legal questions. If you have any further questions, please do not hesitate to contact us.

1. Lawyer Vu Thi Phuong Thanh, Manager of TLA Law LLC, Ha Noi Bar Association

Email: vtpthanh@tlalaw.vn

2. Lawyer Tran My Le, Chairman of the Members’ Council, Ha Noi Bar Association

Email: tmle@tlalaw.vn

– Phan Thế Cường –