In international trade, standardizing the terms and conditions for the delivery of goods is key to ensuring smooth transactions and reducing disputes. Incoterms, short for International Commercial Terms, were established by the International Chamber of Commerce (ICC) to create a standard set of rules for parties engaged in international transactions. This article delves into the concept, significance, and practical application of Incoterms.

1. Concept of Incoterms

Incoterms are a set of international rules designed to clarify the responsibilities, costs, and risks between sellers and buyers in the transaction of goods. Since being introduced in 1936, Incoterms have undergone several revisions to adapt to changes in international trade. The latest version is Incoterms 2020, issued by the ICC to be widely used globally.

2. Role of Incoterms in International Trade

Incoterms address legal issues arising from international transactions by:

- Defining the responsibilities of buyers and sellers: Incoterms clearly specify who bears the costs of delivery, transportation, insurance, and customs obligations.

- Reducing disputes: By establishing standard rules, Incoterms help reduce disputes over rights and responsibilities.

- Facilitating efficient transactions: Clear rules help transactions proceed quickly without lengthy negotiations.

3. Basic Incoterms Conditions

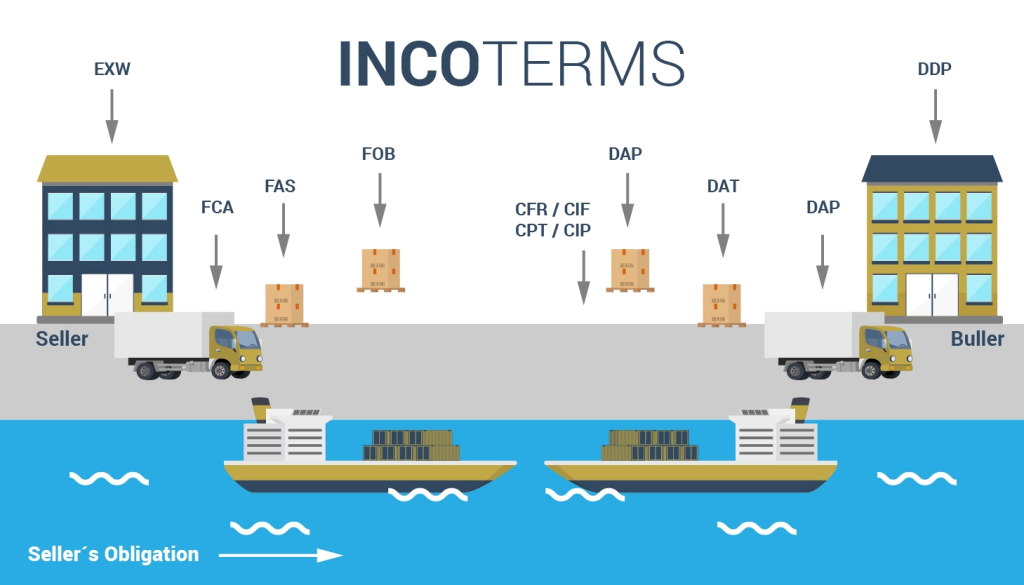

The Incoterms 2020 version includes 11 conditions divided into two main groups:

3.1. Group for All Modes of Transport

- EXW (Ex Works): EXW stands for Ex Works. Under the EXW condition, goods are delivered to the buyer when the seller places the goods at the buyer’s disposal at the seller’s premises or another named place (such as a factory, warehouse, etc.); this named place does not necessarily have to be a facility of the seller. The seller is not obligated to load the goods onto any collecting vehicle nor is required to clear the goods for export. The buyer bears all costs and risks involved in taking the goods from the seller’s premises to the desired destination. The EXW term can be used for any mode of transport and is particularly suitable for domestic trade. The parties should specify the place of delivery as clearly as possible. This helps determine when and where the goods and risks are transferred from the seller to the buyer. If the parties do not specify a precise place within the named place of delivery, the seller can choose the most suitable point for delivery.

- FCA (Free Carrier): FCA stands for Free Carrier. The FCA term means that the seller delivers the goods to the carrier or another person nominated by the buyer. The goods can be delivered in two ways:

- First, when the place of delivery is the seller’s premises, the goods are delivered when they are loaded onto the collecting vehicle.

- Second, when the place of delivery is elsewhere, the goods are delivered when they are placed at the disposal of the carrier or another person nominated by the buyer on the seller’s vehicle ready for unloading.

- CPT (Carriage Paid To): CPT stands for Carriage Paid To. Under the CPT condition, the seller delivers the goods to the carrier or another person nominated by the seller at an agreed place, and the seller must contract for and pay the cost of carriage necessary to bring the goods to the named destination. When using the CPT term, the seller’s delivery obligation is fulfilled when the goods are handed over to the carrier, not when they reach the destination.

- CIP (Carriage and Insurance Paid To): CIP stands for Carriage and Insurance Paid To. Under this condition, the goods and risks are transferred to the buyer when the seller delivers the goods to the carrier or another person nominated by the seller at an agreed place (if such a place has been agreed upon). The seller must also contract for and pay the costs of carriage necessary to bring the goods to the named destination. Additionally, the seller must purchase insurance for the goods. The seller fulfills their delivery obligation when the goods are handed over to the carrier, not when they reach the final destination.

- DAP (Delivered at Place): DAP stands for Delivered at Place. Under this condition, the seller delivers the goods when they are placed at the disposal of the buyer on the arriving means of transport and ready for unloading at the named place of destination. The seller bears all risks involved in bringing the goods to the named place.

- DPU (Delivered at Place Unloaded): DPU stands for Delivered at Place Unloaded. This condition means that the seller delivers when the goods are placed at the disposal of the buyer after being unloaded from the arriving means of transport at the named place of destination. The seller bears all risks involved in bringing the goods to and unloading them at the named place. DPU is the only Incoterms condition requiring the seller to unload the goods at the destination. Thus, the seller must ensure they have the capability to organize the unloading or consider using the DAP condition if they cannot.

- DDP (Delivered Duty Paid): DDP stands for Delivered Duty Paid. Under this condition, the seller delivers the goods when they have been cleared for import and placed at the disposal of the buyer on the arriving means of transport and ready for unloading at the named place of destination. The seller bears all the costs and risks involved in bringing the goods to the named place, including duties, taxes, and other official charges payable upon importation, as well as the costs of customs formalities.

3.2. Group for Sea Transport

- FAS (Free Alongside Ship): FAS stands for Free Alongside Ship. Under this condition, the seller delivers the goods when they are placed alongside the ship at the named port of shipment.

- FOB (Free on Board): FOB stands for Free on Board. The seller delivers the goods on board the ship, and from that point, the risk transfers to the buyer.

- CFR (Cost and Freight): CFR stands for Cost and Freight. The seller pays the costs and freight necessary to bring the goods to the named port of destination.

- CIF (Cost, Insurance and Freight): CIF stands for Cost, Insurance and Freight. Similar to CFR, but in addition, the seller must procure insurance for the goods.

4. Advantages and Disadvantages of Using Incoterms

4.1. Advantages

- Time-saving: Incoterms help buyers and sellers quickly reach an agreement on transactions.

- Transparency: Clearly defines roles and responsibilities.

- Increased reliability: Facilitates smooth transactions and reduces the risk of disputes.

4.2. Disadvantages

- Complex for newcomers: The rules can be complicated and confusing for those who are not familiar.

- No guarantee of resolving issues: Incoterms are not legal contracts.

5. Applying Incoterms in Practice

When using Incoterms, parties should:

- Choose the appropriate term: Consider the specifics of the transaction.

- Detail the contract: Clearly state the version of Incoterms being used.

- Consult experts: Seek legal assistance if in doubt.

Incoterms are crucial tools to ensure that international transactions are conducted efficiently and transparently. However, parties involved must understand and correctly apply the rules to avoid unnecessary disputes. By doing so, Incoterms can effectively function as an essential guide in international trade.

—————————-

📞 CONTACT LEGAL CONSULTANT:

TLA Law is a leading law firm with a team of highly experienced lawyers specializing in criminal, civil, corporate, marriage and family law, and more. We are committed to providing comprehensive legal support and answering all your legal questions. If you have any further questions, please do not hesitate to contact us.

1. Lawyer Vu Thi Phuong Thanh, Manager of TLA Law LLC, Ha Noi Bar Association

Email: vtpthanh@tlalaw.vn

2. Lawyer Tran My Le, Chairman of the Members’ Council, Ha Noi Bar Association

Email: tmle@tlalaw.vn.

_Nguyen Thu Phuong_